The WHO declared the novel coronavirus (COVID-19) outbreak a global pandemic on March 11, 2020. Due to disruption in normal operation, there has been a constant tug-of-war between reducing the spread of the contagion at one end and getting the economy back on the track on the other hand. Urban India is more strongly hit as compared to the rural. The 30-day moving average of urban unemployment rate was 9.54% on September 6, 2020 as compared to 9.41% in March and 25.79% in May 2020. The salaried class working in private, small and medium businesses and self-employed professionals in non-essential sectors are taking the brunt of economic slowdown.

Households are facing a new normal with kids adapting to home schooling and indoor life, adults managing household chores with minimal support system and attending to work from home, which has blurred the line between personal and professional lives. Work-life balance is completely off balance in this new normal. The pandemic has disrupted economic and social processes and systems. It has altered people’s behavior and their orientation towards various products and services. These new behaviors, needs and orientations are shaping up a new cohort for businesses. However, we still do not know if this is a temporary phenomenon while the fear of pandemic lasts or it’s a change that’s here to stay! It is therefore crucial for businesses to assess the changing attitudes and behaviors of the urban Indian consumer.

The ResearchWe conducted the research among 2680 people across the country (representing 230 cities) to understand their consumption behavior in this new normal. The study was conducted during May 25th and June 20th; which marked the transition time between lockdown 3 and unlock 1.

54% respondents represented Tier 1 cities, 34% from Tier 2 and the rest 7% were from Tier 3. North India had majority representation at 47.6% followed by West and South at 24.8% and 19.6% respectively. 73% were males and 27% females with Generation X representing 24% of the sample, Gen Y- 56% and Gen Z constituting 20% of the sample. 21.5% respondents had monthly household income exceeding Rs 3 lakh per month, 11.3% with Rs. 1- Rs. 1.5 lakh pm. 17.3% belonged to Rs. 1.5- Rs 3 lakh p.m bracket and the rest 50% had monthly income ranging between Rs.50,000 to Rs 1 lakh. Some of the insights and conclusions drawn from the study are:

Fear of pandemic and catching the infection themselves plagued the nation and its people. Even as the country was preparing for its first unlock, 57% of respondents across the nation were extremely concerned and bothered about COVID-19 and its lingering impact on their health and lifestyle. Females (76%) were more worried than Males (54%) probably because of their role orientation and concern for the family’s welfare.

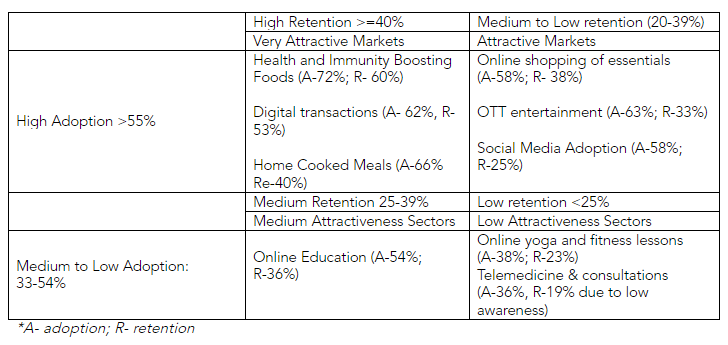

Impact of pandemic on eating habits and choice of foodThe study showed that just 18% urban consumers were consuming health and immunity boosting food whereas 72% new users started consuming these during the pandemic and 60% new users wanted to continue to do so after pandemic. No wonder that sales of Chavanprash and Tulsi drops etc. saw a steep increase during these times. This new trend and love for boosting immunity and preventing infections definitely points towards a huge opportunity for packaged food, dietary supplements, natural and immunity boosting foods. Once people resume work, they may not have time to follow complete rituals and would seek quick and easy solutions.

Fear of infection spread and being locked inside homes made people discover new love for home cooked food. 66% urban consumers are spending more time on home cooked meals and 40% would like to continue this habit. 26% of them are spending more time on cooking meals at home but are not sure if with hectic work-schedule they would be able to sustain it. Surprisingly 19% respondents did not increase the time spent on home cooked meals during pandemic. They continued to supplement their meals through order in packaged meals or from restaurants; whereas for 15%, home cooked meals were the ritual even pre pandemic. Attachment to home cooked meals could be more wishful than practical for many Gen Y and Gen Z dual income nuclear families in urban India as they spend most of their time at work. However, it seems that people have understood the health benefits of self-cooked meals. This definitely opens an opportunity for ventures that promise the goodness and taste of home food and opens doors of additional income for women who would like to start tiffin services, or launch DIY home cooked meal kits, new kitchen gadgets and the like.

Tryst with physical and mental fitness

While there are questions on ‘work from home’ lifestyle and blurring boundaries, it definitely saved people a lot of travel time especially in Tier 1 and metro towns. People started devoting this time to their fitness regime, the need for which was also heightened by sedentary lifestyles and the lack of exercise. People seem to have jumped on to online fitness bandwagon by enrolling into yoga or gym classes. Our study has suggested that 48% consumers have neither adopted this habit nor practiced it earlier. However, 38% respondents did enroll for such lessons and 23% intend to continue with the same. 26% of these respondents belong to Gen Z and 32% are females. The data clearly shows that young females are more health and body conscious as compared to young males. However, we forecast that online yoga and fitness market may not sustain for long as younger people are more active and such moments are an opportunity for them to interact and network with peers. Hence, they prefer going to gyms or join physical classes.

Tele-medicine and health consultations

Decreased mobility coupled with the fear of visiting hospitals spiked teleconsultations with health care providers. From our sample, 36% new users have been added to telemedicine market during pandemic and only 19% would like to continue with the same. Whopping 53% are not aware of the same and have not tried it during the pandemic; whereas 5% of those who tried did not find it effective. Tier 1 cities in West India showed more positive attitude towards telemedicine as compared to others. Awareness and usage of telemedicine is low among all segments and would require investment in creation of this service category.

Shifts in Consumption Behavior- “The 3 Es gain”

Ecommerce

One of the major shifts in behavior was the adoption of e-commerce. Out of our sample, 58% new customers are added to the online grocery market and 38% would continue to shop online. India needs to ramp up its supply chain and logistics to upgrade ecommerce services. 19% online buyers have been on ecommerce platform before while 23% consumers did not use it even during the pandemic. Among the new users, females (44%) are more likely to continue buying online as compared to Males (35%). Gen Y shows maximum adoption (42%) and western India leads in online shopping. Surprisingly, there is no significant difference in online shopping among Tier 1,2 and 3 towns which indeed points to a significant opportunity in this space. Though neighborhood chemist shops had been operating during the pandemic as they were considered essentials, 32% new customers bought medicines online and would like to continue with it. This trend is highest in Tier 3 towns (36% adoption) as against 30% adoption in Tier 1. Consumers have also become more comfortable with digital transactions and use of digital payment methods. Companies like PayTM and Google-pay have seen unprecedented growth due to fear of physical exchange of cards or currency. 53% new users have adopted digital payments during these times. Only 5% of our respondents have not used any digital payments till now.

Education

People have used the free time available during pandemic to upgrade their knowledge and skills. They believed that this time could be better used to enhance their CV and also take advantage of top universities offering online courses. 54% new customers were added to the online learning market during the pandemic, out of these 36% would like to continue seeking online courses. However, 35% have not taken any course online. We believe that though the education sector will see a sea change in their pedagogy, delivery and markets in future times with greater adaption of technology, the current trend to enroll for webinars and short-term courses is short-lived. People will move on with their lives, work and look for education opportunities that truly complements their career choice and expectations.

Entertainment

With closure of malls, cinema halls, theaters, parks etc., people had to find entertainment options at home. Cable television relied on the re-run of some classics. Though the telecast of Ramayana took the nation by storm as it did 30 years back; the biggest growth was seen in OTT platforms. They offered new shows, movies, etc. this new fare became an indispensable part of households. OTT platforms have garnered 33% new users who plan to continue watching movies and content there. Consumers seemed to be hooked on to these for variety, economy and convenience. 33% new users, mostly Gen Y and Gen Z, subscribed to membership of these OTT platforms. Other, 30% new viewers who subscribed to these new platforms are not sure if they would have time to continue. The adoption of this new form of entertainment remains similar across various regions and income groups. In our opinion, though people may not be able to spend similar time on these platforms post pandemic, they have got hooked on to the habit of on-demand entertainment. This would evolve to be a new emerging sector in India.

People are also spending more time on social media platforms to interact and connect with family and friends. Whether this interest would sustain or fizzle out is to be seen but digital and social media marketing will definitely occupy greater share of brand’s media expenses.

Key takeaways and Conclusions: Future drivers

With every adversity comes new challenges and opportunities. Businesses have to start re-looking at last few months to understand how they have shaped consumers and their behaviors. Not all that changed is sustainable and hence investments made there may not reap positive ROI. It is important to assess the new markets and opportunities carefully to evaluate if they are fads or here to stay.

-Sangeeta is founder-director at Prastut Consulting, Gurgaon; Ashita is the professor of marketing at Bhavan's SPJIMR, Mumbai. Views expressed are personal.

"behavior" - Google News

September 14, 2020 at 10:47AM

https://ift.tt/2RkLNPg

Decoding consumer behavior during pandemic - ETBrandEquity.com

"behavior" - Google News

https://ift.tt/2We9Kdi

Bagikan Berita Ini

0 Response to "Decoding consumer behavior during pandemic - ETBrandEquity.com"

Post a Comment