Subscribe to The Financial Brand via email for FREE!

Clearly COVID-19 impacted consumer behavior globally as many consumers were forced to work from home, financial institutions closed lobbies and people worried about everything touched by others. The question has been whether initial changes in activities would become fundamental behavioral shifts once the pandemic ended. With people beginning to settle into what their “new normal” might be, financial institutions must do the same.

The shift to digital banking on the part of both consumers and financial institutions was already taking place before COVID-19, but the health crisis definitely served as a jolt to the trial and adoption rate as in-person engagement was discouraged or even prohibited. Digital payments were also rising before the pandemic, with more consumers using mobile wallets each month. As the direct impact of the pandemic enters the third month outside of Asia, there are several trends that provide a strong indication of banking and payment behavior going forward.

As social distancing requirements loosen and distribution channels reopen, financial institutions are realizing that just because consumers will be able to visit branches doesn’t mean they will. And, just because the coronavirus may not be spreading to the same degree as in March, going back to using cash, checks or point-of-sale systems requiring tactile engagement may not be worth the risk.

In a survey of over 1,000 American consumers done by FIS between April 3-5, the findings support the belief that COVID-19 has accelerated the digital transformation of banking, payments and commerce, supporting the potential for a “new normal” in consumer behavior post-COVID-19.

The research found that:

- More than 45% of respondents say they have permanently changed how they interact with their bank since COVID-19.

- 31% of respondents will use online or mobile banking more in the future.

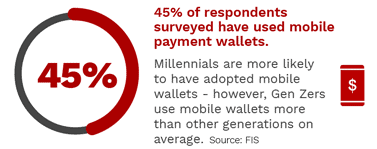

- 45% of consumers have used a mobile wallet payment platform in the past 30 days.

- There will be a measurable shift away from cash and checks.

- 40% said they will shop online more in the future than in a store.

“The impact of COVID-19 has rapidly accelerated trends that we have been seeing for years in terms of banking and digital payments,” said Mladen Vladic, General Manager, Loyalty, FIS. “Once consumers begin using convenient new digital services, few tend to go back to their old habits, so we expect this to be the new normal going forward.”

Read More:

Daily Banking Has Changed … For Now

Given the combination of work-from-home requirements and the shutdown of most banking lobbies and many banking branches altogether, many consumers were left with few options other than to change their branch-based behaviors. According to FIS, 45% of respondents said the way they conduct banking has changed permanently due to COVID-19.

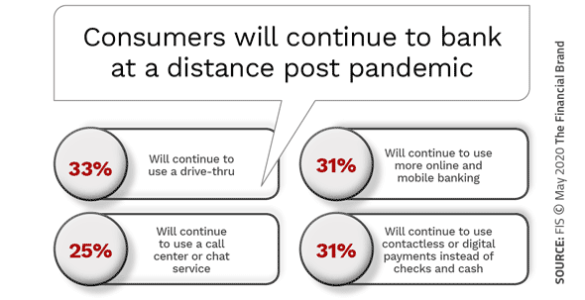

Some have moved from in the branch to the drive-thru lane, some have increased their use of their bank’s call center, while others have increased their use of online and mobile banking.

Some have moved from in the branch to the drive-thru lane, some have increased their use of their bank’s call center, while others have increased their use of online and mobile banking.

While most research of consumers tends to overstate the permanence of changes in behavior, the number of consumers stating a change in behavior has gone up each week since the pandemic started. For these digital behaviors to become habitual in the long-term, financial institutions will need to continue to commit to digital transformation.

This includes the simplification of digital account opening and digital engagement throughout the customer journey. It requires a redesign of online and mobile applications with an emphasis on user experience including the removal of friction that originates in the back office.

This includes the simplification of digital account opening and digital engagement throughout the customer journey. It requires a redesign of online and mobile applications with an emphasis on user experience including the removal of friction that originates in the back office.

Marketing of the benefits of digital banking alternatives must increase as does the contextualization of digital engagement. During this pandemic, consumers have become acutely aware of how firms can personalize experiences to improve daily life. They expect nothing less from their financial institution.

Read More:

REGISTER FOR THIS FREE WEBINAR

Improving Digital Banking Experiences in a New Consumer Reality

The COVID-19 pandemic has moved the majority of consumer and small business banking engagement to digital channels. Register for this webinar from Informatica to learn more.

Tuesday, june 16th at 2pm EST

Digital Payments Get COVID-19 Boost

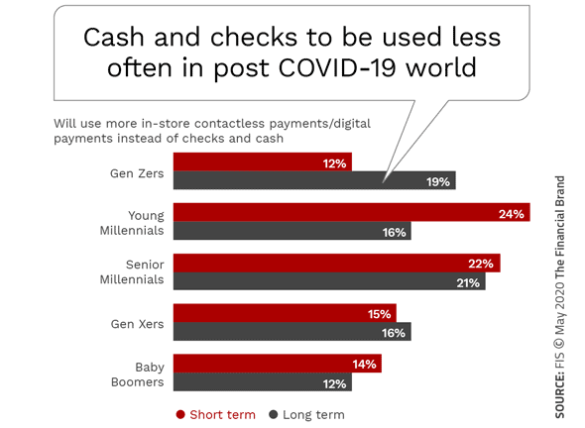

Until COVID-19, the move to digital payments and away from cash and checks had been steady, but subdued. The coronavirus crisis has definitely hastened the shift in payment behavior. More than ever, consumers are buying products online. This has tremendously increased the use of digital payment options, and reduced POS, cash and check usage.

Contributing to these trends is the desire to avoid touching a keypad (increasing contactless payments and mobile wallet use) or using potentially germ-laden cash. Even though scientific evidence does not support the probability of coronavirus transmission through banknotes or coins, consumer anxiety about physical currency has sped up the trend towards touchless payments.

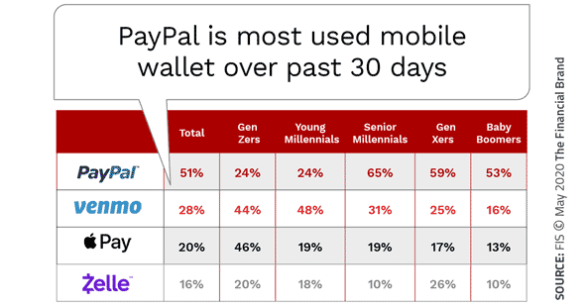

Mobile wallet use has probably been the biggest beneficiary of the COVID-19 crisis. FIS reports that 51% of consumers surveyed had used PayPal in the 30 days prior to the April 3-5 research. Interestingly, the lowest use was among the youngest consumers. During the same period, 28% of consumers used Venmo (skewed towards younger consumers), with 20% using Apple Pay and 16% using Zelle.

The majority of businesses are encouraging cashless transactions as well, from fast food restaurants to retailers to toll booths on the highways. Even the World Health Organization is encouraging contactless payments where possible.

Read More:

It’s Time to Focus on Sustainable Finance

In the past, sustainable finance was associated with environmental efforts by financial institutions, from investing is “green” initiatives to building carbon neutral facilities. Today, sustainable finance is more broadly defined to include social purposes such as education, healthcare or local business support.

One of the many impacts of COVID-19 is the impact of the disease on lower income and minority households. The loss of income, the higher incidence of disease and the lack of adequate healthcare to name a few. Obviously, the pandemic has also shuttered many small businesses in every community, with the prospects of reopening being doubtful.

It is important for financial organizations to be a positive force as we rebound both on a health and economic basis. Not only is investment in a broad focus of local sustainable finance good for the consumers being served, but it makes positive business sense.

According to EY, more than half of consumers state that their purchasing patterns and financial institution loyalty will be impacted by financial institutions actively supporting the community. Conversely, 44% stated that their loyalty will be negatively impacted if their financial institution focuses on maximizing profits during and after COVID-19.

Embrace Change and Disrupt Status Quo

The shift to digital has impacted all industries and virtually all forms of personal, professional and transactional interaction. As consumers begin to realize that it will take time for businesses to operate in a way close to what was happening before COVID-19, new ways of doing business are becoming habitual. In fact, many who have moved to digital banking and digital payments say they won’t return to “business as usual” post-pandemic.

This is the perfect time for financial institutions of all sizes to reduce physical branch networks, double down on digital banking investment, leverage new technologies, encourage digital payments and partner with fintech firms that can assist with all of these transformations. Strains on the revenues of financial institutions in the foreseeable future should serve to accelerate these trends.

"behavior" - Google News

May 18, 2020 at 11:07AM

https://ift.tt/3fYuQ8r

COVID-19 Has Changed Banking and Payments Behavior Forever - The Financial Brand

"behavior" - Google News

https://ift.tt/2We9Kdi

Bagikan Berita Ini

0 Response to "COVID-19 Has Changed Banking and Payments Behavior Forever - The Financial Brand"

Post a Comment